BREAKING NEWS ALERT: Warren Buffett’s $981 Million Bank of America Sell-Off: The Alarming Signal of an Imminent Market Crash!

Ready to uncover the truth? Sick of the lies? Join our Telegram Channel now. It’s time for the real story! Stay informed! My gratitude to all my readers!

Discover why Warren Buffett’s massive sell-off of $981 million in Bank of America shares could signal an impending U.S. market crash. Uncover the warning signs of small bank failures and an IT bubble set to burst, and learn how to protect your wealth in the face of a financial meltdown.

Warren Buffett’s Sell-Off Signals Catastrophic US Market Crash

Warren Buffett, the Oracle of Omaha himself, has offloaded another staggering $981 million in Bank of America shares. This sudden divestment has sent shockwaves through the markets, with analysts and investors alike bracing for what could be the most devastating market crash in recent history.

September is already shaping up to be a month of financial carnage, with U.S. banking and the IT sector set to experience unprecedented shocks. But what does this all mean for the average investor? Are we on the brink of another Great Recession? Buckle up because the signs are ominous, and the fallout could be catastrophic.

The Oracle of Omaha’s Ominous Move: A Bellwether of Impending Doom

When Warren Buffett makes a move, the world pays attention. Known for his long-term investment strategies and almost supernatural ability to predict market trends, Buffett’s decisions often serve as a harbinger for the financial world. His recent decision to sell nearly $1 billion in Bank of America shares is not just another transaction; it’s a blaring alarm that something is terribly wrong.

Buffett has historically been a staunch supporter of Bank of America, holding a massive stake in the company for years. His sell-off is therefore not just surprising—it’s alarming. What could have prompted this drastic move? The answer lies in the broader financial landscape, where small banks are collapsing like a house of cards, and the U.S. IT sector is teetering on the edge of a precipice. Buffett’s actions suggest he’s foreseeing a market upheaval, one that could rival or even surpass the dot-com bubble burst of the early 2000s.

The Domino Effect: Small Banks Falling and the Larger Implications

Across the United States, small banks are failing at an alarming rate. This is not just a minor inconvenience for local economies—it’s a sign of a much larger, systemic issue. The failure of these banks is a canary in the coal mine, indicating that the financial infrastructure of the U.S. is far more fragile than it appears.

These small banks, often the lifeblood of local communities, are crumbling under the weight of bad loans, reduced consumer confidence, and increasing competition from larger financial institutions. But the real danger lies in the domino effect that these failures could trigger. As these banks fail, they drag down the communities they serve, leading to job losses, reduced economic activity, and a decrease in property values. This, in turn, can lead to a broader economic downturn, especially in rural areas where these banks are often the only financial institutions available.

Moreover, the failure of small banks can erode confidence in the banking sector as a whole. If consumers and businesses begin to believe that their money is not safe in a bank, they will start to pull their deposits, leading to liquidity crises even in larger, more stable institutions. This is how financial panics start, and once they begin, they are incredibly difficult to stop.

How Trump Cheated Death!

Imagine this: One of the most powerful men on the planet, Donald Trump, faced with the ultimate end—yet he SURVIVES against all odds. How? The answer is SHOCKING and now within your reach…

The IT Bubble: Bigger, More Dangerous, and Ready to Burst

While the banking sector faces its own set of challenges, the U.S. IT industry is sitting on a bubble that’s even bigger and more dangerous. The parallels between the current IT sector and the dot-com bubble of the late 1990s are striking. Overvalued tech stocks, a flood of venture capital into speculative startups, and a culture of growth at all costs have created a market that’s ripe for a catastrophic collapse.

The dot-com bubble burst in 2000 wiped out trillions of dollars in market value, decimating investors and leading to a prolonged economic downturn. The bubble we’re currently witnessing in the IT sector could be even worse. Companies that are valued in the billions despite never turning a profit, speculative technologies like blockchain and AI that have yet to prove their long-term viability, and an overreliance on cheap credit are all signs that the market is overheated.

When this bubble bursts—and it’s not a question of if, but when—the consequences will be severe. The IT sector is deeply integrated into every aspect of modern life, from finance to healthcare to national security. A collapse in this sector would have far-reaching implications, leading to widespread job losses, a sharp decline in consumer confidence, and potentially even a recession.

The Perfect Storm: How Banking and IT Could Trigger an Economic Meltdown

What makes the current situation so dangerous is the interplay between the banking sector and the IT industry. These two sectors are not isolated; they are deeply interconnected, and a collapse in one could easily trigger a collapse in the other.

The banking sector is heavily invested in the IT industry. Banks have poured billions of dollars into tech startups, hoping to cash in on the next big thing. They’ve also integrated technology into every aspect of their operations, from online banking platforms to automated trading systems. If the IT bubble bursts, banks could find themselves holding billions of dollars in worthless assets, leading to massive losses and potentially even bankruptcies.

At the same time, the IT sector relies on the banking industry for funding. Venture capital firms and tech companies borrow heavily from banks to fund their operations and fuel their growth. If banks start to fail, the flow of credit to the tech industry will dry up, leading to a wave of bankruptcies and job losses in the sector. This could trigger a broader economic downturn, as the loss of jobs and wealth in the tech industry ripples through the economy.

The Historical Precedent: Lessons from the Dot-Com Bubble and 2008 Financial Crisis

To understand the gravity of the current situation, it’s worth looking back at two of the most significant financial crises in recent history: the dot-com bubble of 2000 and the 2008 financial crisis. Both of these events were marked by speculative bubbles, overvalued assets, and a lack of regulation—just like what we’re seeing today.

The dot-com bubble was driven by irrational exuberance in the tech sector. Investors poured money into any company with a .com in its name, regardless of whether it had a viable business model. When the bubble burst, trillions of dollars in wealth evaporated almost overnight. The economy took years to recover, and many investors never regained their losses.

The 2008 financial crisis was similarly driven by speculative investments, this time in the housing market. Banks and other financial institutions created complex financial products that were poorly understood and overleveraged. When the housing market collapsed, these products became worthless, leading to a cascade of failures throughout the financial system.

Attention: The Biggest Scandal in Human History! Christ Consciousness Code: Jesus’ 18 “Lost Years” Reveals…

In both cases, the root cause of the crisis was the same: a lack of regulation and oversight, combined with a speculative bubble that was allowed to grow too large. The current situation in the IT and banking sectors bears a striking resemblance to these past crises. If history is any guide, the outcome could be similarly devastating.

The Role of the Federal Reserve: Can It Prevent a Crash?

As the U.S. faces the possibility of a financial meltdown, all eyes are on the Federal Reserve. The Fed has a crucial role to play in preventing a crisis, but it’s unclear whether it has the tools or the will to do so.

The Fed’s primary tool for managing the economy is interest rates. By raising or lowering rates, the Fed can influence the cost of borrowing, which in turn affects consumer spending, business investment, and overall economic growth. In the past, the Fed has used rate cuts to stave off recessions and support economic recovery. However, the current economic situation presents a unique challenge.

Interest rates are already near historic lows, leaving the Fed with little room to maneuver. If the IT bubble bursts or the banking sector starts to collapse, the Fed may not have the ability to lower rates further to stimulate the economy. Moreover, the Fed’s balance sheet is already bloated from years of quantitative easing, which limits its ability to inject liquidity into the market.

There’s also the question of inflation. The Fed has been walking a tightrope between supporting economic growth and preventing inflation from spiraling out of control. If the economy starts to tank, the Fed may be forced to choose between keeping rates low to support growth or raising them to combat inflation. Either choice could have serious consequences for the economy.

Guides and Angels: Embracing the Presence of Spiritual Guides in Our Lives!

Investor Strategies: Protecting Wealth in Turbulent Times

For investors, the prospect of a market crash is terrifying. However, there are steps that can be taken to protect wealth and even profit from the turmoil.

First and foremost, diversification is key. Investors should spread their investments across a range of asset classes, including stocks, bonds, real estate, and commodities. This helps to mitigate the risk of any one investment losing value in a market downturn.

Second, investors should consider shifting their portfolios toward more defensive assets. This could include stocks in sectors that tend to perform well in a recession, such as consumer staples, healthcare, and utilities. Bonds, particularly government bonds, are also a safe haven in times of economic uncertainty.

Third, it’s important to stay informed and be prepared to act quickly. Markets can move rapidly in a crisis, and investors who are slow to react can suffer significant losses. Keeping a close eye on market developments and having a plan in place for different scenarios can help investors navigate turbulent times.

Finally, some investors may want to consider shorting overvalued stocks or sectors. This is a more aggressive strategy that involves betting that the price of an asset will fall. If the IT bubble bursts, for example, investors who shorted tech stocks could make significant profits. However, shorting is risky and should only be done by experienced investors.

The Global Implications: A U.S. Crash Could Trigger Worldwide Turmoil

The U.S. economy is the largest in the world, and a crash in the U.S. would have significant global implications. Other countries are heavily invested in the U.S. economy, and many rely on the U.S. as a major market for their exports. A downturn in the U.S. would likely lead to a slowdown in global growth and could trigger financial crises in other countries.

Emerging markets, in particular, could be hit hard by a U.S. crash. These economies are often highly dependent on exports to the U.S., and a slowdown in the U.S. would lead to reduced demand for their products. Additionally, many emerging markets rely on foreign investment to fuel their growth, and a crisis in the U.S. could lead to capital flight, further exacerbating their economic problems.

Even developed economies are not immune to the fallout from a U.S. crash. The European Union, for example, is still grappling with the economic fallout from Brexit and the COVID-19 pandemic. A downturn in the U.S. could tip the EU into recession and exacerbate existing economic problems.

The Social Consequences: Unemployment, Inequality, and Social Unrest

A financial crash doesn’t just have economic consequences—it has social consequences as well. A downturn in the economy would likely lead to a spike in unemployment as businesses cut back on spending and lay off workers. This would be particularly devastating in industries that are already struggling, such as retail, hospitality, and manufacturing.

Unemployment, in turn, could lead to an increase in inequality. Those at the bottom of the economic ladder are often the first to lose their jobs in a downturn and the last to find new employment. This can lead to a widening gap between the rich and the poor, exacerbating social tensions and leading to increased social unrest.

We’ve already seen signs of this in recent years, with protests and social movements gaining traction across the globe. A financial crash could provide the spark that ignites these movements, leading to widespread unrest and potentially even violence. Governments will need to be prepared to address these issues and provide support to those who are hardest hit by the crisis.

Preparing for the Worst: What Can Individuals Do?

For individuals, the prospect of a financial crash is daunting. However, there are steps that can be taken to prepare for the worst.

First and foremost, it’s important to have an emergency fund. This should be enough to cover at least three to six months’ worth of living expenses. This will provide a cushion in the event of job loss or other financial difficulties.

Second, individuals should consider paying down debt. High levels of debt can be a significant burden in a downturn, especially if interest rates rise. By paying down debt now, individuals can reduce their financial obligations and free up cash flow in the event of an economic downturn.

Third, it’s important to be mindful of spending. In times of economic uncertainty, it’s a good idea to cut back on discretionary spending and focus on saving. This can help individuals build up their savings and prepare for potential financial difficulties.

Finally, it’s important to stay informed and be prepared to adapt. The economic landscape can change rapidly, and those who are informed and prepared are more likely to weather the storm.

Conclusion: The Calm Before the Storm

Warren Buffett’s decision to sell nearly $1 billion in Bank of America shares is a clear sign that something is seriously wrong with the U.S. financial system. The failures of small banks and the growing bubble in the IT sector are just the tip of the iceberg. As we head into September, the signs of an impending financial crash are becoming impossible to ignore.

The time to prepare is now. Investors, businesses, and individuals alike need to take steps to protect themselves from the coming storm. Diversification, paying down debt, and building up savings are all crucial strategies for surviving what could be the most significant financial crisis in recent history.

The warning signs are there. The question is, will we heed them?

![BREAKING! CODE GREEN: TRUMP DEPLOYS NATIONAL GUARD IN LOS ANGELES – MILITARY OPERATION TO LIBERATE CALIFORNIA UNDERWAY | NEWSOM SURRENDERS, TROOPS MOVE IN [VIDEO]](https://amg-news.com/wp-content/uploads/2025/06/Trump-National-Guard-California-450x253.png)

5 Comments

Yes, dear.

his clone is dancing-thats all. People think its him,regardless,he;s selling his stock and the world follows suit. its gonna crash no matter what-make sure you have enough toilet paper on board to weather the storm!! And the majority of people do not have 3-6 months savings in the bank, they are barely making it as it is-and even if they did and the bank closes then they aint getting it out anyways…

Bank of America is going under ——-> JIM WILLIE TALKED ABOUT THIS !!!!!!!!!! WHEN THAT HAPPENS WATCH ALL THE OTHER BANKS ALSO CRASH

Your message is awaiting moderation. Why all of a sudden?

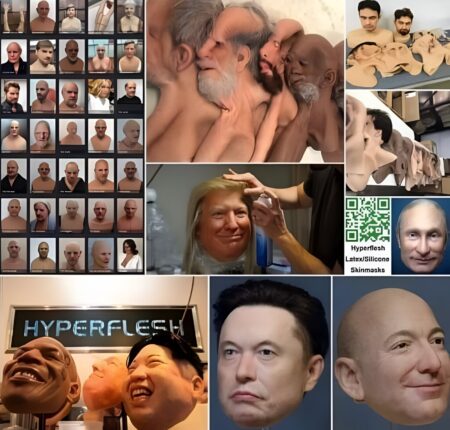

Warren Buffett was executed by the military in 2020, maybe earlier. This whole stupid circus is starting to get boring. You won’t wake anyone up. These are NPC androids printed in 3D printers