BREAKING NEWS: Thousands of Bank of America Customers Locked Out of Accounts Amid Widespread Outages

Ready to uncover the truth? Sick of the lies? Join our Telegram Channel now. It’s time for the real story! My gratitude to all my readers!

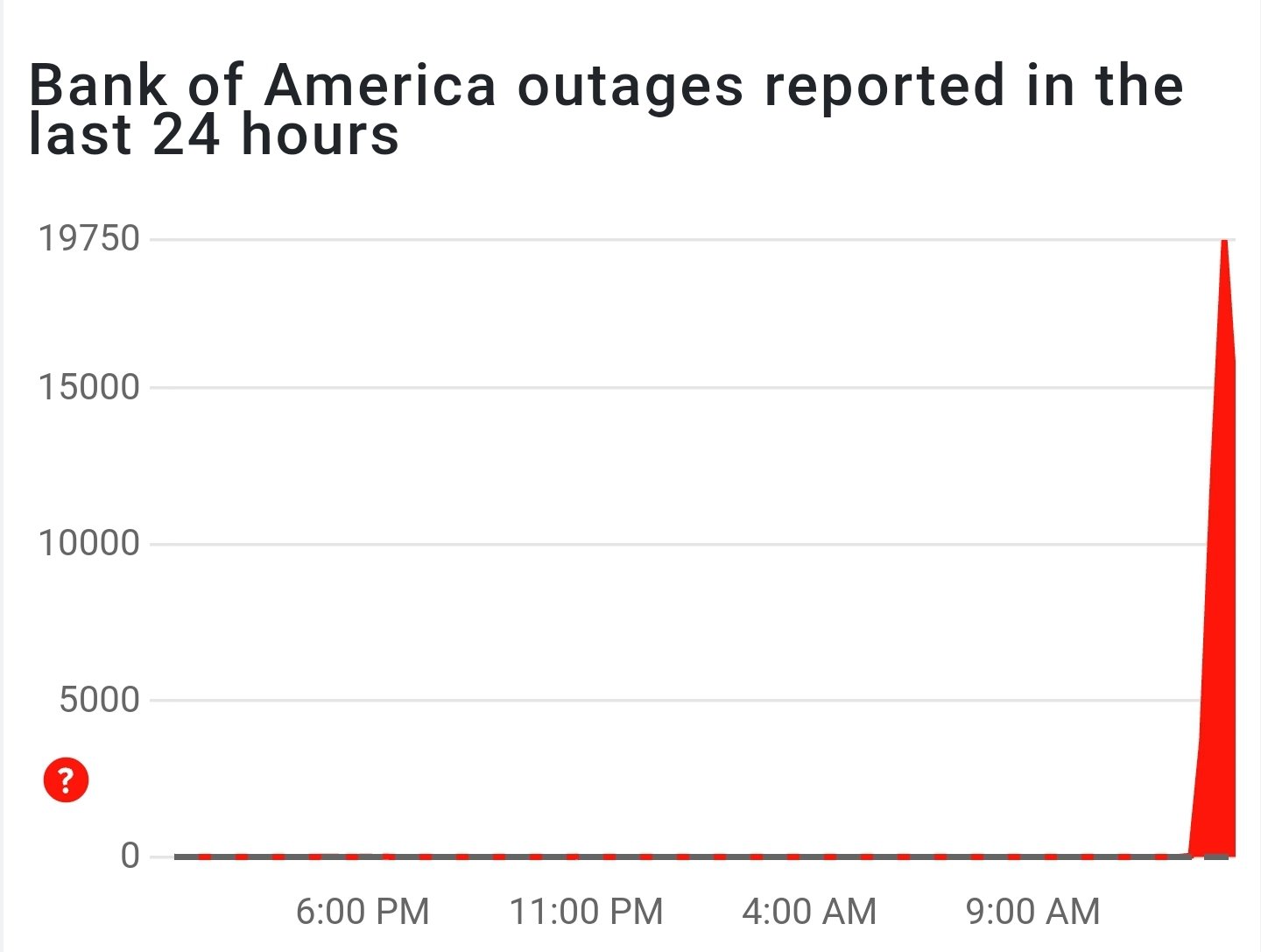

Thousands of Bank of America customers face widespread outages, locked out of their accounts, and seeing zero balances. Panic sets in as debts remain visible, and the bank scrambles to fix this shocking glitch. Trust is shattered—what’s really going on?

Thousands of Bank of America customers are waking up to a nightmare. Widespread outages have left many locked out of their accounts, and those who manage to get in are met with a terrifying surprise—their balances are showing as zero. Yet, ominously, their debts are still hauntingly visible. This unsettling glitch has left account holders panicking, and the banking giant is scrambling to address the issue. But what’s really going on behind the scenes?

Outage Chaos: Customers Cut Off from Access

The extent of the outage is sweeping, affecting thousands, if not millions, of Bank of America customers across the country. It’s a gut-wrenching scene: customers attempting to log into their accounts, only to be denied access. Frantic refreshes and multiple login attempts are yielding nothing but frustration, while the bank’s systems remain inaccessible. This widespread outage isn’t just a technical hiccup; it’s a full-scale collapse of access to personal finances. For customers, this isn’t just an inconvenience; it’s an alarming experience that raises serious questions about the bank’s reliability and transparency.

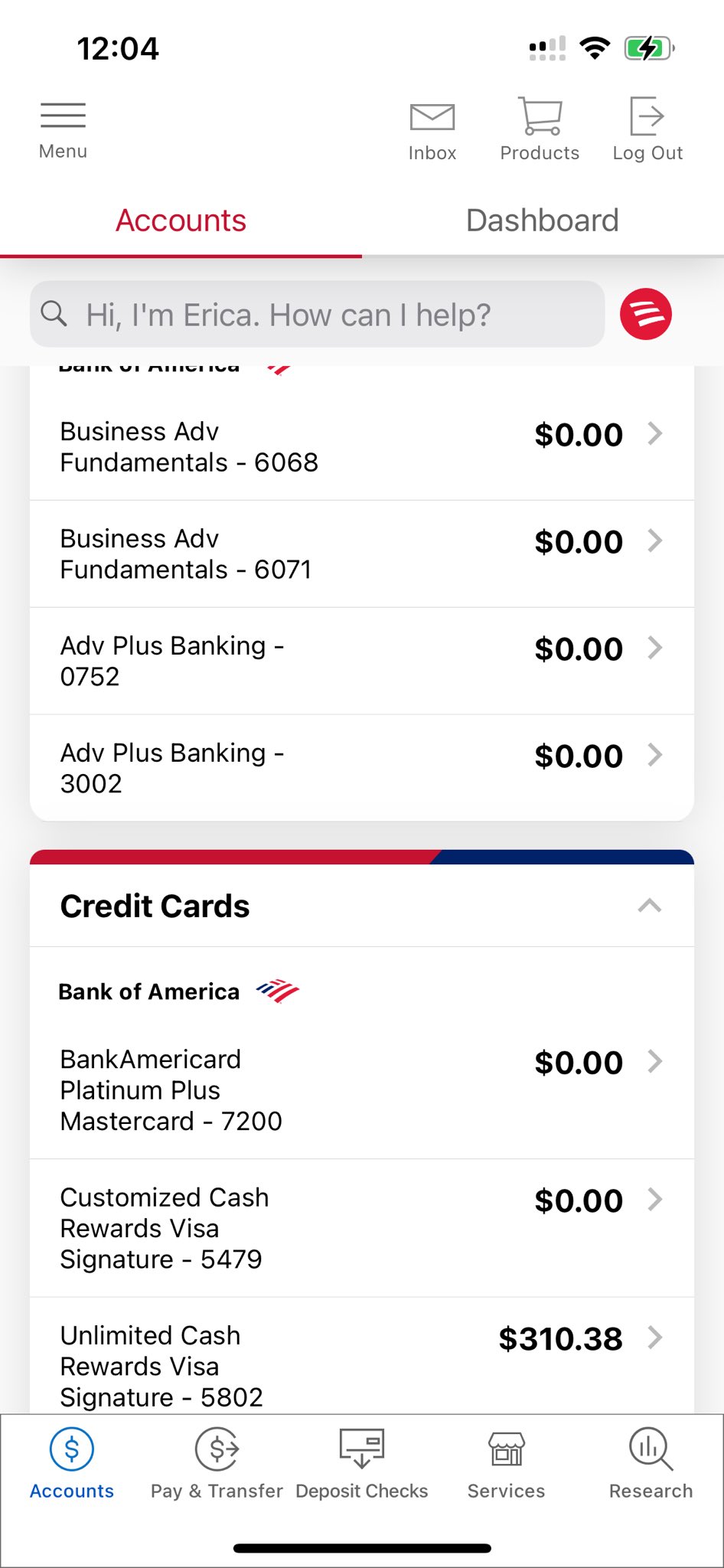

Balances Wiped to Zero: The Heart-Stopping Moment

For those lucky enough to get past the login hurdle, the relief is short-lived. Many Bank of America users are reporting that once logged in, they are greeted with a stark, shocking sight: their account balances show zero dollars. Imagine the sinking feeling of seeing all your hard-earned money vanish without explanation. This is a gut-punch moment that has sent countless customers into a panic, sparking fear over their financial stability and well-being. Adding to the bizarre scenario, while balances are showing as zero, all outstanding debts and liabilities remain fully visible.

SEE ALSO: BOOOM!!! TRUMP JUST GAVE THE GREEN LIGHT, LETS GOOOO! The War to Reclaim America Starts NOW!

The fact that debts remain while assets appear wiped out is more than just unsettling—it’s a glaring inconsistency that suggests a deeper technical failure. It raises questions about how secure and robust Bank of America’s digital infrastructure really is. Customers are left wondering: Is this really just a glitch, or is there more to the story?

Bank of America’s Response: A Weak Attempt at Reassurance

Bank of America’s response to this catastrophe has been less than comforting. In an official statement, the bank acknowledged the issue as a “glitch” that their technical teams are “working to resolve.” But for the thousands affected, this explanation feels like a slap in the face. A “glitch” is a word that minimizes the terrifying reality of what’s happening—people’s life savings appear to have vanished, and the bank’s calm, almost dismissive tone, has only added fuel to the fire.

The timeline for fixing this so-called glitch is unclear, leaving customers in the dark about when—or even if—their money will reappear. The lack of transparency and detail in Bank of America’s communication has done little to calm fears. It begs the question: Is this really just a technical issue, or does it reveal larger vulnerabilities in the bank’s financial system?

A Crisis of Trust: How This Impacts Bank of America’s Reputation

This is more than just a technical mishap; it’s a monumental crisis of trust. Bank of America has long marketed itself as a reliable institution for handling the financial well-being of its customers. But this massive glitch has shattered that perception. Customers are now left questioning whether they can depend on the bank to safeguard their money.

In the age of digital banking, where most transactions are done online, trust in a bank’s digital infrastructure is paramount. This incident is more than an inconvenience—it’s a breach of trust. If a bank of this scale can suffer such a significant outage, what does that say about the security of its systems and the protection of its customers’ assets?

The Human Toll: Stress, Uncertainty, and Financial Panic

It’s easy to talk about “outages” and “glitches,” but the human impact of this disaster cannot be understated. People are left unable to access their money—funds that are needed to pay rent, buy groceries, cover medical expenses, and handle everyday needs. The stress, anxiety, and fear gripping these customers are palpable. Imagine needing to pay your bills, only to find that your account balance is gone, and your bank has no answers.

This incident has thrown countless families and individuals into a state of financial panic, unsure of when they will regain access to their money. Bank of America’s “glitch” is more than a technical issue; it’s a crisis that has left people questioning their financial future, creating an environment of uncertainty and fear.

What Happens Next? Uncertainty Looms Large

With Bank of America’s systems still not fully operational, and balances mysteriously disappearing, customers are left to play the waiting game. When will their accounts be restored? Will their funds reappear intact, or is there a risk of permanent loss? These are the pressing questions on the minds of every affected customer, but Bank of America’s vague assurances aren’t providing real comfort.

This incident shines a glaring spotlight on the vulnerability of digital banking and the importance of backup systems and customer support in the financial sector. For Bank of America, this is a wake-up call—a demand for stronger systems, better communication, and a more customer-centric approach. For customers, it’s a harsh reminder of how quickly access to their money can be jeopardized.

Final Thoughts: A Call for Accountability

Bank of America’s massive outage and ensuing “glitch” represent a crisis not just in technology but in customer trust. The bank must step up, take full accountability, and ensure that such an incident never happens again. Until then, thousands of customers are left in a state of financial limbo, demanding answers, transparency, and most importantly, access to their money. The fallout from this incident is far from over, and the onus is now on Bank of America to restore faith in its systems and its ability to protect its customers’ financial well-being.

Thousands of Bank of America customers are facing widespread outages, with many locked out of their accounts.

Those who manage to log in are shocked to find their balances at zero, though their debts remain visible.

Bank of America's customer support has acknowledged the… pic.twitter.com/TReJTgMxvy

— Shadow of Ezra (@ShadowofEzra) October 2, 2024

SOURCE: https://x.com/ShadowofEzra/status/1841537239370621148

![BREAKING! CODE GREEN: TRUMP DEPLOYS NATIONAL GUARD IN LOS ANGELES – MILITARY OPERATION TO LIBERATE CALIFORNIA UNDERWAY | NEWSOM SURRENDERS, TROOPS MOVE IN [VIDEO]](https://amg-news.com/wp-content/uploads/2025/06/Trump-National-Guard-California-450x253.png)