Breaking News: US Treasury’s Bold Move Set to Ignite Bullish Surge in the Markets!

Ready to uncover the truth? Sick of the lies? Join our Telegram Channel now. It’s time for the real story! My gratitude to all my readers!

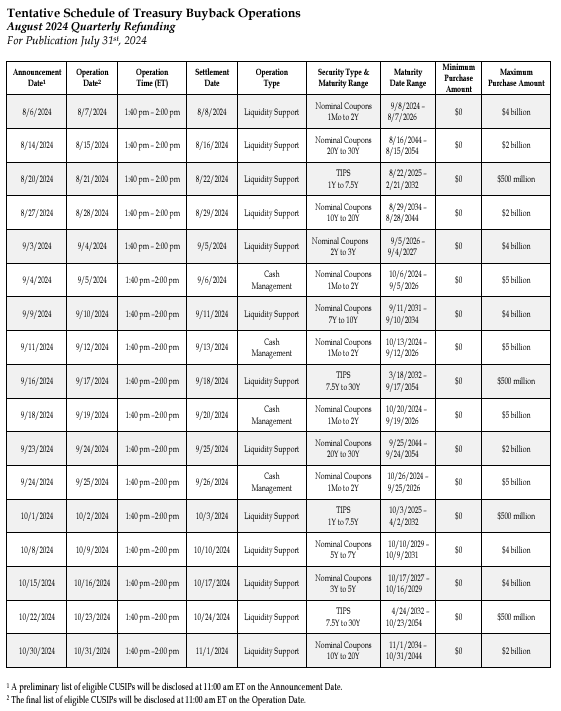

The US Treasury’s massive bond buyback program, starting August 6th, 2024, is set to inject billions into the economy, increase liquidity, lower interest rates, and boost market confidence. This unprecedented move could ignite a bullish surge and spark an economic boom.

What Exactly is Happening?

The Treasury’s plan involves purchasing back billions of dollars’ worth of bonds from the market. In simple terms, they are effectively “printing money” to facilitate these buybacks. This influx of cash is poised to increase liquidity in the financial system, with far-reaching consequences. The move is designed to drive bond prices up while simultaneously pushing yields down, a combination that typically results in lower interest rates.

The Mechanics of Bond Buybacks. To fully grasp the magnitude of this announcement, it’s essential to understand the mechanics of bond buybacks. When the Treasury buys back bonds, it essentially reduces the supply of these securities in the market. This reduction in supply typically leads to higher bond prices because investors are willing to pay a premium for the remaining bonds. As bond prices rise, their yields (or interest rates) fall. This dynamic can have a ripple effect across various sectors of the economy.

The Ripple Effects: Increased Liquidity

Why Liquidity Matters. Increased liquidity is the first and most immediate effect of the Treasury’s bond buyback strategy. Liquidity refers to the ease with which assets can be converted into cash without affecting their market price. When there’s more money circulating in the economy, businesses can access capital more readily and at lower costs. This availability of cheaper capital can spur expansion and growth across multiple industries.

The Impact on Businesses. For businesses, increased liquidity means easier access to funds needed for investment, expansion, and operations. Companies that were previously struggling to secure financing can now tap into the newly available resources. This can lead to the launch of new projects, the expansion of existing operations, and ultimately, job creation. As businesses grow and expand, the positive effects can ripple through the economy, benefiting workers, consumers, and investors alike.

Consumer Benefits. Consumers stand to gain from increased liquidity as well. With more money flowing through the economy, banks and financial institutions are more likely to offer favorable loan terms. This means lower interest rates on mortgages, auto loans, and personal loans. For individuals looking to buy a home, start a business, or make significant purchases, the Treasury’s actions could translate into substantial savings.

Lower Interest Rates: A Game Changer

How Bond Buybacks Lower Interest Rates. One of the key outcomes of bond buybacks is the reduction in interest rates. As mentioned earlier, the Treasury’s purchase of bonds reduces their supply in the market, driving up prices and pushing yields down. Lower yields on government bonds often lead to lower interest rates across the board. This can have a profound impact on borrowing costs for both consumers and businesses.

Benefits for Consumers. For consumers, lower interest rates mean more affordable loans. Homebuyers, in particular, can benefit from reduced mortgage rates, making homeownership more accessible. Similarly, lower rates on auto loans can make purchasing a car more affordable. For those carrying existing debt, refinancing at lower rates can lead to significant savings on interest payments.

Benefits for Businesses. Businesses, too, can reap the rewards of lower interest rates. Lower borrowing costs mean that companies can finance expansion projects, research and development, and other growth initiatives at a lower expense. This can lead to increased innovation, job creation, and overall economic growth. Additionally, lower interest rates can boost consumer spending, as individuals feel more confident in their financial stability.

Benefits for Businesses. Businesses, too, can reap the rewards of lower interest rates. Lower borrowing costs mean that companies can finance expansion projects, research and development, and other growth initiatives at a lower expense. This can lead to increased innovation, job creation, and overall economic growth. Additionally, lower interest rates can boost consumer spending, as individuals feel more confident in their financial stability.

Market Confidence: A Bold Signal

The Treasury’s Vote of Confidence. The Treasury’s decision to undertake such a massive bond buyback operation sends a strong signal of confidence in the economy’s future. This move can reassure investors and market participants that the government is committed to supporting economic growth and stability. This confidence can translate into increased investment in the stock market, driving up prices and creating a positive feedback loop.

Attracting Investors. Investors, both domestic and international, are likely to view the Treasury’s actions as a sign of a robust and resilient economy. This perception can attract new capital to the markets, further fueling the bullish surge. As stock prices rise, the wealth effect can lead to increased consumer spending and investment, amplifying the positive impact on the economy.

Stock Market Implications. For the stock market, the implications of increased market confidence are profound. Rising stock prices can boost investor sentiment and encourage further investment. Companies with higher stock valuations can also benefit from increased access to capital, as they can raise funds more easily through stock offerings. This, in turn, can support business expansion and innovation.

The Potential for an Economic Boom

A Perfect Storm for Growth. The combination of increased liquidity, lower interest rates, and heightened market confidence creates a perfect storm for economic growth. Businesses can expand more easily, consumers can access affordable financing, and investors can benefit from rising stock prices. These factors together can set the stage for a significant economic boom.

Long-Term Prospects. While the immediate effects of the Treasury’s bond buyback strategy are promising, the long-term prospects are equally exciting. Sustained economic growth can lead to higher employment rates, increased consumer spending, and a more prosperous society overall. As businesses thrive and innovate, the benefits can extend to various sectors of the economy, creating a virtuous cycle of growth and development.

Risks and Considerations. However, it’s important to acknowledge the potential risks and considerations associated with such a bold move. Injecting massive liquidity into the economy can also lead to inflationary pressures. The Treasury and other regulatory bodies will need to carefully monitor and manage these risks to ensure that the benefits of increased liquidity and lower interest rates are not offset by rising inflation.

In conclusion, the US Treasury’s announcement of a massive bond buyback operation starting on August 6th, 2024, is a game-changing event with the potential to ignite a bullish surge in the markets. The increased liquidity, lower interest rates, and heightened market confidence resulting from this move can create a perfect storm for economic growth. While there are risks to consider, the overall prospects for businesses, consumers, and investors are overwhelmingly positive.

As the markets brace for this unprecedented action, it’s crucial for investors to stay informed and seize the opportunities presented by this potential economic boom. Whether you’re a seasoned investor or a newcomer to the financial markets, understanding the implications of the Treasury’s bold move can help you make informed decisions and maximize your potential gains. So keep your eyes on the markets, stay informed, and be ready to take advantage of this exciting moment in economic history.

https://twitter.com/echodatruth/status/1820882525470023794

![BREAKING! CODE GREEN: TRUMP DEPLOYS NATIONAL GUARD IN LOS ANGELES – MILITARY OPERATION TO LIBERATE CALIFORNIA UNDERWAY | NEWSOM SURRENDERS, TROOPS MOVE IN [VIDEO]](https://amg-news.com/wp-content/uploads/2025/06/Trump-National-Guard-California-450x253.png)

8 Comments

Yes, dear.

Je ne vois absolument pas en quoi c’est une bonne chose…

Une FED qui crée de la richesse avec rien n’est qu’une fraude et une tromperie.

En même temps vue le système….

I THINK WE HAVE BEEN HAD. REAL AMERICANS, WHATS LEFT IN THIS COUNTRY BETTER STAND AND FIGHT. AND IT MAYBE TO LATE!

If the treasury does this..then every article you have written about the white hats is nonsense and there is no GCR..The fed is still kicking and has not been absorb by the president. This means the Cabal and bankers are still running the show and this major liquidity move will spike the markets boost the economy and reinsert the democrats in power ..welcome president kamala..

If the treasury does this..then every article you have written about the white hats is nonsense and there is no GCR..The fed is still kicking and has not been absorb by the president. This means the Cabal and bankers are still running the show and this major liquidity move will spike the markets boost the economy and reinsert the democrats in power ..welcome president kamala..

Je ne vois absolument pas en quoi c’est une bonne chose…

Une FED qui crée de la richesse avec rien n’est qu’une fraude et une tromperie.

En même temps vue le système….

You are 100% correct. This has no value except to buy time (and inflation). Will it be enough time to see Obamala installed? We’ll find out (but I don’t think so)! 🙂

Ads to tempt investors?