The Financial Tsunami is HERE: Crypto Predictions, Next Black Swan, XRP, QFS, GCR, US Treasury Note and Cryptocurrency Regulations (Goldilocks)

Medeea Greere, an independent publisher, is now on Telegram at https://t.me/AMGNEWS2022 and exists only on reader support as we publish Truth, Freedom and Love for public awareness. Thank You for your support!

Digital assets are not just coming; they have arrived, wielding the power to reshape our financial foundations from the ground up.

What Have We Continually Shown Here? For years, naysayers and traditionalists have dismissed the viability of digital currencies and assets, tethering their beliefs to outdated systems that are now gasping for breath under the weight of innovation. Digital assets are not the relics of a failed attempt at a one-world currency, as some fearmongers might claim. They are the vanguard of a new financial era.

We’ve delved deep into the heart of this new world, examining the crux of digital transformation through the lens of technologies like RippleNet and the promises of XRP—a currency allegedly backed by gold. These are not mere speculations but the building blocks of the forthcoming financial infrastructure, a system poised to replace the archaic SWIFT network and redefine interbank and interpersonal monetary transfers.

Don’t Miss This:

The Impending Demise of Traditional Systems. Reports of the death of the traditional Federal Reserve and central banking systems aren’t exaggerated. They are a reality we must face as these institutions falter under the demands of modern economics. In their place rises a new, transparent framework that promises to retain the familiarity of old systems while revolutionizing the backend with blockchain and other digital technologies.

The introduction of the U.S. Treasury Note (USTN) is a temporary measure, a bridge to ease the transition as society acclimates to the digital asset ecosystem. This transition period is crucial, allowing users to become comfortable with digital assets that will soon become commonplace.

The Forbidden Prayer: How a Vatican-Banned Invocation Influenced Trump’s Presidency! GOD BLESS AMERICA !!! GOD BLESS YOU ALL !!!

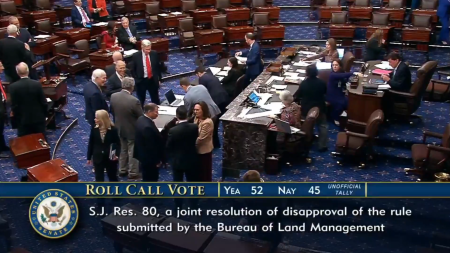

Disregard cryptocurrency’s role in politics at your peril. As the U.S. presidential race heats up, digital currency has become a hot-button issue, closely monitored by an electorate increasingly cognizant of its implications on the national and global economy. With new legislation poised to regulate Market in Crypto Assets (MiCA) and stablecoins by the end of June, the landscape is set for a drastic overhaul.

Post-June, the crypto landscape will witness a Darwinian culling of sorts. Tokens and currencies unable to meet the new regulatory standards will vanish into the ether, while those that align with the legal frameworks and are backed by tangible assets like gold and commodities will flourish. These changes are designed to stabilize digital currencies and ensure they reflect the economic stature of their respective nations.

A Vision for Ripple and Beyond. Ripple stands at the forefront of this financial revolution, poised to facilitate cross-border transactions that will challenge and potentially destabilize the dominance of traditional fiat currencies like the U.S. dollar. As Ripple begins to catalyze currency market opportunities, it will underscore the shift towards valuing currencies based on real demand and supply, backed by physical commodities.

THE RED PILL: Discover The Secret Used By A Former CIA Scientist To Open Your ‘3rd EYE’

The second half of this year marks a critical phase as sectors across the market begin to experience the impact of transitioning to asset-backed digital currencies. This shift promises to bring about what could be a Black Swan Event—temporary market turmoil as industries and investors adjust to the new norm where utility trumps speculation.

Watch the Water! In financial terms, ‘liquidity’ is everything, and as we move forward, keeping an eye on how smoothly assets can be converted into cash—watching the water—will be more vital than ever. The era of speculative bubbles is giving way to an era where real value, real transparency, and real economic principles reign supreme.

Ripple CEO Brad Garlinghouse sparked speculations with his recent comments on the SEC lawsuit, crypto market predictions, crypto non-partisanship, XRP victory, upcoming Black Swan event.

Ripple CEO Brad Garlinghouse answers key questions while sharing key insights on topics like joining and scaling Ripple, fighting the long-running lawsuit against the U.S. Securities and Exchange Commission (SEC), and crypto market predictions & future of blockchain technology.

Besides, he also discussed making an impact with XRP in the universe, lessons learned over the years in Silicon Valley, and key moves to finding success and lasting happiness.

Ripple CEO Brad Garlinghouse’s Insights on SEC Lawsuit

Brad Garlinghouse, CEO of Ripple Labs, in an interview with Chris Vasquez, host of World Class Podcast, explained the company took risks to fight the securities regulator SEC for clarity and stop the “bully” SEC from attacking the crypto market.

He said Judge Torres’ summary judgment on July 13 was key learning and one of the best days. Garlinghouse added that the SEC has been trying to settle the lawsuit to “create a narrative that Ripple’s been a bad actor.” Despite appeals and other arguments, Brad Garlinghouse is confident that the SEC is going to lose in the long run.

In response to crypto becoming a partisan issue in the U.S., Brad Garlinghouse asserts this will end up being the issue that pushes swing state voters away from the Democrats. He blames Senator Elizabeth Warren for politicizing it and Democrats fails to realize that she is “leading them off a cliff.”

Crypto Market Predictions

Ripple CEO reaffirmed the crypto market can hit a $5 trillion market cap by the end of this year. He advised people to think of long term investments, trading is what he doesn’t recommend going straight into crypto trading.

He indirectly hints at XRP price rally as the impact of the SEC lawsuit fades away this year. XRP price is still undervalued due to the lawsuit with the price currently trading range near $0.50.

He believes there will be black swan events in the crypto industry. He said “Do I think there’s going to be another Black Swan of course 100%. I just don’t know exactly what it is.

He predicted that the SEC is going after USDT-issuer Tether, believing it is the only one that’s going to be an interesting one to watch. Moreover, he doesn’t believe there’s a risk of Quantum Computing to the crypto market at large.

XRP Lawsuit and Remedies Update

Lawyer James Murphy, also known as “MetaLawMan,” believes Judge Torres might dismiss the SEC’s disgorgement argument that institutional investors suffered pecuniary harm due to the use of the SEC v. iFresh case to reason disgorgement, which is a “not for publication”.

Moreover, the SEC has attacked Ripple’s plan to issue stablecoin to seek injunctions, trying to sabotage XRP ODL sales. Ripple can use the court’s opinion and ruling in Binance lawsuit to counter the SEC’s claims that the new stablecoin is an unregistered crypto asset.

The rise of digital assets is not just an evolution—it is a revolution. As we navigate this tumultuous transition, the resilience and readiness to adapt will determine who thrives and who falls by the wayside in this new economic order. Embrace the change, for digital assets are not just the future; they are the now.

ARTICLE SOURCE: https://coingape.com/breaking-ripple-ceo-brad-garlinghouse-on-sec-lawsuit-crypto-predictions-xrp-victory/

![BOOM! 1913 EXPOSED: TRUMP STRIKES FINAL BLOW TO THE IRS — TARIFFS IN, INCOME TAX OUT – President Trump Announces Plan to Erase Federal Income Tax and Restore Pre-1913 American Prosperity Through Tariffs [VIDEO]](https://amg-news.com/wp-content/uploads/2025/09/TRUMP-STRIKES-FINAL-BLOW-TO-THE-IRS-450x255.png)

![BREAKING! THEY’RE POISONING OUR LAND ON PURPOSE: U.S. FARMS UNDER CHEMICAL ATTACK – PFAS, Sewage Sludge & The Systematic Killing of America’s Food Supply [VIDEO]](https://amg-news.com/wp-content/uploads/2025/05/Hazardous-pesticide-450x304.jpg)