The US Debt Clock Secret Window: The Kennedy Factor: Challenging the Federal Reserve – The Emergency Banking Act of 1933: A Historical Parallel

Medeea Greere, an independent publisher, is now on Telegram at https://t.me/AMGNEWS2022 and exists only on reader support as we publish Truth, Freedom and Love for public awareness. Thank You for your support!

US Debt Clock: Revealing the Secret Window to Economic Transformation

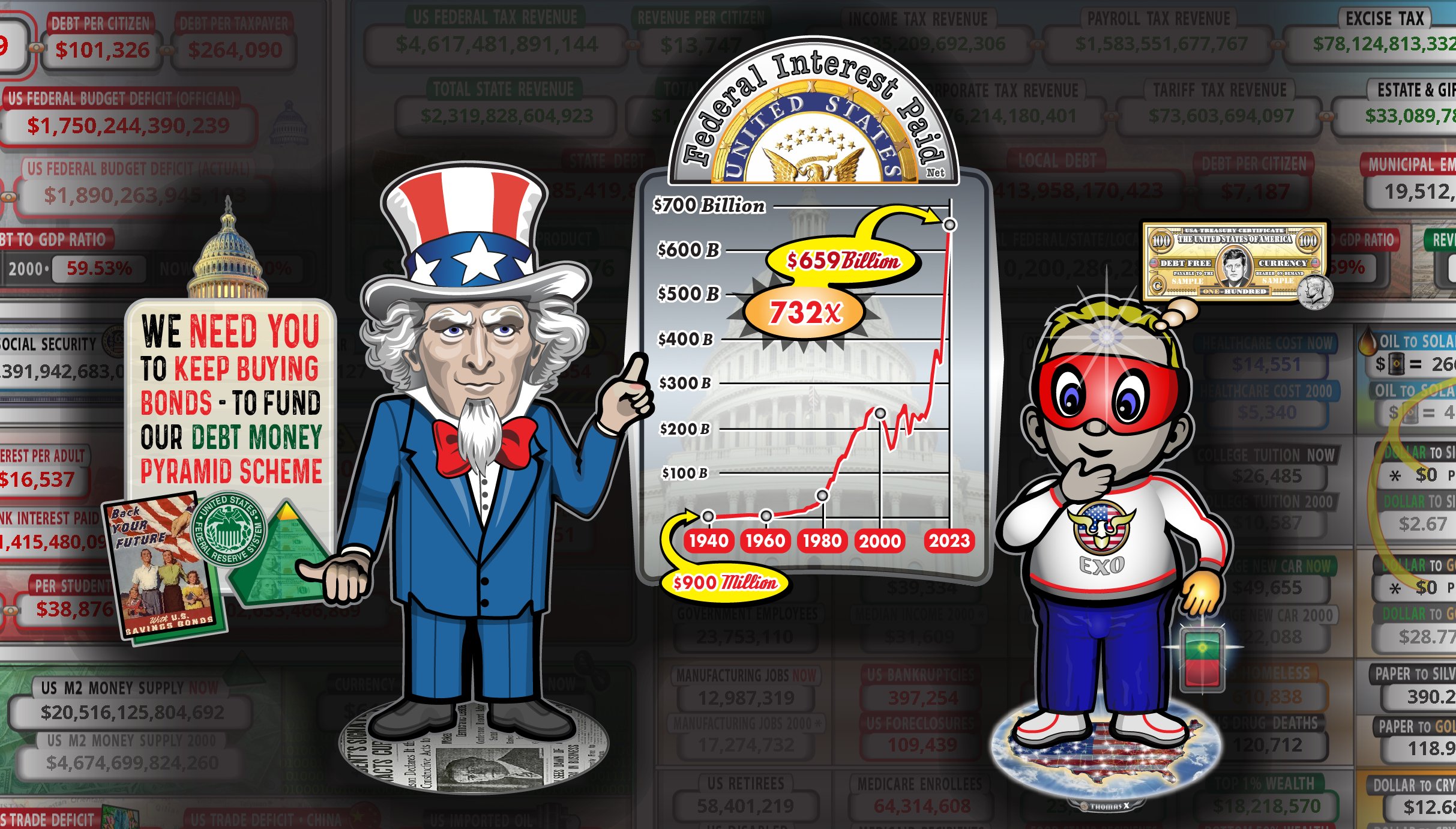

In the annals of American history, certain events have sparked conversations about the nation’s financial health and independence. One such topic that has gained traction among both experts and everyday citizens is the intriguing notion of flipping the switch on the US Debt Clock. Join us on a journey to explore this clandestine realm and discover how it could hold the key to reshaping the nation’s economic future.

The United States, often regarded as a global economic powerhouse, has a shadow lurking in the background – its ever-increasing national debt. Throughout history, there have been moments when prominent figures in American politics sought to address this issue and potentially change the trajectory of the nation’s financial landscape.

Could the US Debt Clock be the secret window through which such transformative change could occur? In this article, we delve into the intriguing past, present, and future of the US Debt Clock and the enigmatic forces that may be influencing it.

The Kennedy Factor: Challenging the Federal Reserve One of the most compelling stories related to the US Debt Clock revolves around President John F. Kennedy’s audacious attempt to challenge the Federal Reserve System. Kennedy, known for his charismatic leadership, had a vision to eliminate the Federal Reserve’s hold over the US monetary system. His weapon of choice? Executive Order 11110.

Executive Order 11110: The Game Changer In June 1963, President Kennedy signed Executive Order 11110, which sought to authorize the United States Treasury to issue a new form of currency – the United States Notes, also known as Silver Certificates. These notes would be backed by silver reserves, effectively bypassing the Federal Reserve’s control over the nation’s money supply.

Kennedy’s motivation behind this executive order was clear: he aimed to reduce the influence of the Federal Reserve and provide the American people with a more stable and transparent currency. The switch from Federal Reserve Notes (FRN) to Silver Certificates was seen as a bold step towards regaining control of the nation’s monetary policy.

However, just five months after the issuance of Executive Order 11110, President Kennedy was tragically assassinated in Dallas, Texas. The executive order was never fully implemented, and the Federal Reserve maintained its dominant position over the nation’s currency.

SEE ALSO: DISCLOSED: President John F. Kennedy, The Fed and Executive Order 11110

The US Debt Clock: A Hidden Indicator Fast forward to the present day, and the US Debt Clock serves as a stark reminder of the nation’s growing debt burden. But is it merely a passive indicator, or does it hold a secret window to transformative change?

- Cross-Border Interbank Payment System (CIPS) One intriguing development on the global financial stage is the emergence of the Cross-Border Interbank Payment System, known as CIPS. This Chinese alternative to SWIFT (Society for Worldwide Interbank Financial Telecommunication) poses a challenge to the long-standing dominance of the latter in international money transfers. As the world shifts towards multipolar economic power, CIPS represents a potential threat to the current financial order.

CIPS offers a more direct, efficient, and cost-effective means of conducting cross-border transactions. Its adoption by various countries could reduce the reliance on the US dollar as the world’s primary reserve currency, potentially affecting the US Debt Clock and the nation’s economic standing.

- System for Transfer of Financial Messages (STFM) Another development to watch closely is the System for Transfer of Financial Messages (STFM). While SWIFT remains the dominant player in this field, alternative systems are being developed to provide competition and potentially reduce the influence of the US in the global financial landscape.

Exchanges and Commodities Pricing Interestingly, some exchanges are gradually shifting towards pricing commodities using the Shanghai Futures Exchange. This move could have far-reaching implications for the global commodities market and, by extension, the US economy. As commodities pricing diversifies away from traditional benchmarks, it could impact the US Debt Clock and the nation’s fiscal health.

The Emergency Banking Act of 1933: A Historical Parallel While we explore these modern developments, it’s essential to acknowledge historical events that have shaped the nation’s financial policies. The image of Franklin D. Roosevelt (FDR) on the newspaper beneath Uncle Sam’s feet is a vivid reminder of the “Emergency Banking Act of 1933.” During this pivotal moment in American history, banks were closed for four days to address the banking crisis of the Great Depression.

ALSO: Leaked CIA Research Reveals Brain Wave Ritual Attracts Money To You-New CIA research makes you wealthy in 7 minutes

The Emergency Banking Act not only stabilized the banking sector but also led to the creation of the Federal Deposit Insurance Corporation (FDIC). This institution continues to play a crucial role in protecting the deposits of American citizens to this day. The parallels between historical events and current financial challenges are unmistakable, underscoring the importance of vigilant oversight and creative solutions to address them.

WARNING: The Vatican Demanded this Be Kept Under Lock and Key: “The Divine Prayer – One Minute Prayer From Biblical Times” VIDEO BELOW

The US Debt Clock’s Secret Window to Transformation In the labyrinthine world of finance and economics, the US Debt Clock stands as a stark and ominous reminder of the nation’s growing debt burden. However, it is also a powerful symbol of the potential for change. Just as President Kennedy sought to challenge the Federal Reserve’s dominance through Executive Order 11110, modern developments like CIPS, STFM, and shifting commodities pricing present opportunities for transformation.

As we navigate the complexities of the global financial landscape, it is crucial to remain vigilant and informed about the forces that may influence our economic future. The US Debt Clock is not merely a numerical display; it is a secret window through which we can glimpse the potential for significant change. Whether that change will be dramatic and aggressive or gradual and calculated remains to be seen, but one thing is certain – we must know what we hold and be prepared to adapt to a shifting financial landscape. In the end, it is our collective awareness and actions that will determine the course of our economic destiny.

The Event 5D – NESARA and GESARA: The United States Gov. the Most Corrupt Place on Earth – Get Rid of Biden, and Start the New Money System! (Where We Go One, We Go All)

The United States government, once seen as a symbol of power and control, now stands at the precipice of transformation. The Quantum Financial System (QFS) is emerging as the catalyst for change, promising to reshape our economic landscape forever. But this transformation is not just about the system; it’s about dismantling the old and forging a new path.

Join us as we delve into the Quantum Financial System, NESARA, GESARA, gold, silver, and the future that awaits us!

Please Share The World!