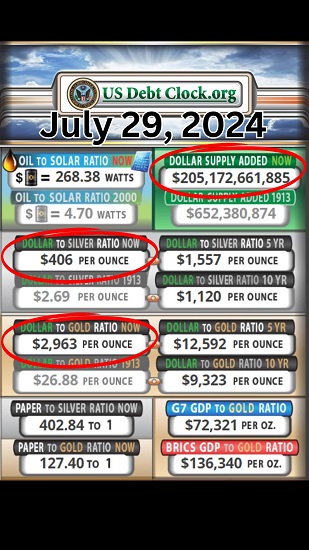

Urgent Financial Alert: US Debt Clock Surge and the Explosive Dollar to Silver Ratio You Need to Know About – US National Debt Just Broke $35 TRILLION for the First Time Ever – $103,827 Debt per US Citizen (VIDEO)

Ready to uncover the truth? Sick of the lies? Join our Telegram Channel now. It’s time for the real story! My gratitude to all my readers!

Urgent Update: The urgent surge in the US Debt Clock and its impact on the Dollar to Silver Ratio. Understand the role of the derivative market in silver pricing, the implications of increased M2 money supply, and strategic investment insights amidst economic instability!

BREAKING: US National Debt just broke $35 TRILLION for the first time ever.

$103,827 debt per US citizen.

Wars don’t pay for themselves…

Urgent Update: US Debt Clock Surges – The Explosive Rise of the Dollar to Silver Ratio and Its Market Impact – The Economic Alarm Bells are Ringing!

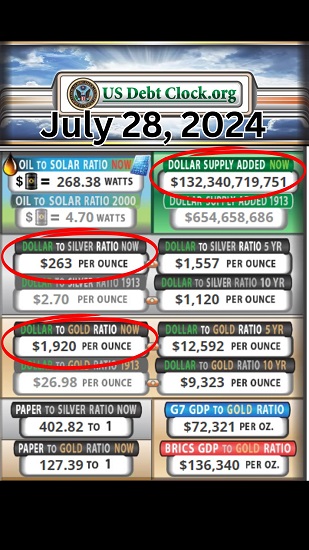

In an astonishing turn of events, the US Debt Clock has shown a staggering increase in the M2 money supply by $73 billion. This massive surge is not just a number—it’s a beacon signaling an imminent financial upheaval. The implications of this increase ripple through the economy, and one of the most critical areas affected is the Dollar to Silver Ratio. This ratio has just skyrocketed, leaving investors and economists scrambling to understand the repercussions. Let’s delve deep into what this means and why it matters now more than ever.

Understanding the Dollar to Silver Ratio: The Basics

What is the Dollar to Silver Ratio? The Dollar to Silver Ratio is a metric used to gauge the hypothetical price of silver per ounce if all the money in circulation were to be backed by silver. It is calculated by dividing the total M2 money supply by the total amount of above-ground silver. This ratio offers a glimpse into what the value of silver could be in a world where it once again serves as a monetary standard.

The Calculation Breakdown. To understand this ratio, we need to break down its components. The M2 money supply includes cash, checking deposits, and easily convertible near money. By dividing this colossal amount by the total available silver, we arrive at a theoretical silver price. As the M2 supply increases, so does the dollar to silver ratio, indicating a potential rise in silver’s value under a silver-backed monetary system.

However, the theoretical price suggested by the dollar to silver ratio is starkly different from the real-time market price of silver. This discrepancy is primarily due to the derivative market, where paper trading significantly influences silver prices.

The Shadow Over Silver: The Impact of the Derivative Market

The Role of Futures Contracts. The derivative market, particularly futures contracts, plays a crucial role in the current pricing of silver. Futures contracts are agreements to buy or sell an asset at a future date for a predetermined price. While they are essential tools for hedging and speculation, they also contribute to significant price manipulation.

The Overwhelming Paper Trading. Currently, there are over 400 paper contracts for each ounce of physical silver. This massive volume of paper silver traded often vastly exceeds the actual physical silver available. The result is a suppressed market price for physical silver, as speculative and manipulative activities dominate the trading landscape.

Speculation and Manipulation. The speculative nature of the futures market allows for price manipulation, where large market players can influence prices through their trading activities. This manipulation can keep silver prices artificially low, detached from the realities of physical supply and demand.

Pray For The Best, Prepare For The Worst – Be Ready! GOD BLESS AMERICA !!! GOD BLESS YOU ALL !!!

The Breaking Point: When Demand for Physical Silver Surges

The Gap Between Paper and Physical Silver. The vast difference between the paper market and the actual physical silver market creates a significant gap. If a large number of investors start buying physical silver, this gap could be dramatically exposed.

Potential Price Surge. A surge in demand for physical silver would reveal the inadequacy of the paper market to cover actual silver needs. This revelation could lead to a sharp increase in silver prices, as the suppressive effects of the derivative market are overwhelmed by real-world demand.

Market Repercussions. Such a price surge would have far-reaching repercussions. It could destabilize the derivative market, lead to massive financial losses for speculators, and force a re-evaluation of silver’s role in the global economy.

The Bigger Picture: Why This Matters Now More Than Ever

Economic Instability. The increase in the M2 money supply and the corresponding rise in the dollar to silver ratio are indicative of broader economic instability. With the global economy already under strain from various crises, the potential for a significant shift in silver prices adds another layer of uncertainty.

Investor Strategies. For investors, understanding the dynamics of the dollar to silver ratio and the impact of the derivative market is crucial. Those who can anticipate the breaking point between paper and physical silver stand to gain significantly, while those caught unprepared could face substantial losses.

Preparing for the Future. Given the current economic climate, it is essential to stay informed and prepared. Keeping an eye on the US Debt Clock and understanding its implications on precious metals like silver can provide valuable insights for future investment decisions.

The recent developments in the US Debt Clock and the resulting implications for the dollar to silver ratio highlight the urgent need for awareness and preparedness. As we navigate these turbulent economic times, understanding the forces at play and their potential impacts can make all the difference. Stay informed, stay prepared, and stay ahead of the curve.

Detailed Analysis and Explanations- The M2 Money Supply Surge: A Closer Look

Understanding M2 Money Supply. The M2 money supply includes cash, checking deposits, and easily convertible near money. This metric is a key indicator of the amount of money circulating within the economy. A sudden increase in the M2 money supply can signal various economic shifts, including inflationary pressures and changes in monetary policy.

The Recent $73 Billion Increase. The recent increase of $73 billion in the M2 money supply is not just a statistical anomaly. It reflects significant monetary policy decisions and economic conditions. Understanding the reasons behind this surge is critical for comprehending its broader implications.

Inflationary Concerns. One of the immediate concerns with an increase in the M2 money supply is inflation. More money in circulation can lead to higher prices for goods and services, diminishing the purchasing power of the dollar. This inflationary pressure can have widespread effects on the economy, from consumer spending to investment strategies.

MAKE AMERICA HEALTHY AGAIN: HOME RETREAT | HOW TO RENEW YOUR CELLS IN 7 DAYS

The Dollar to Silver Ratio: A Historical Perspective

Historical Context. Historically, silver has played a vital role as a monetary standard. Before the advent of fiat currency systems, silver and gold were commonly used to back currencies. Understanding the historical context of the dollar to silver ratio provides insights into its current significance.

Changes Over Time. Over time, the dollar to silver ratio has fluctuated significantly. These fluctuations often reflect broader economic trends and shifts in monetary policy. By examining these historical changes, we can better understand the current dynamics and potential future trends.

The Derivative Market’s Influence on Silver Prices

Futures Contracts Explained. Futures contracts are agreements to buy or sell an asset at a future date for a predetermined price. They are used for hedging against price fluctuations and for speculative purposes. In the silver market, futures contracts play a significant role in price determination.

The Volume of Paper Silver. The sheer volume of paper silver traded in the futures market often exceeds the actual physical silver available. This discrepancy allows for speculative activities that can suppress the market price of physical silver.

Viral Content! AN ICON OF BLESSING AND LIBERTY: THE JESUS COIN, MADE WITH AMERICAN SPIRIT!

Manipulative Activities. Price manipulation in the futures market is a significant concern. Large market players can influence prices through their trading activities, often leading to artificial price suppression. This manipulation distorts the true value of silver, creating a disconnect between the paper and physical markets.

The Implications of a Surge in Physical Silver Demand

Exposing the Gap. If a large number of investors start buying physical silver, the gap between the paper market and the actual supply would become evident. This exposure could lead to a dramatic reassessment of silver’s value.

Price Adjustments. As demand for physical silver increases, prices are likely to rise. This adjustment would reflect the true scarcity of silver and the limitations of the paper market to meet physical demand.

Broader Economic Impact. A significant increase in silver prices would have broader economic implications. It could affect various industries, from electronics to jewelry, and lead to a re-evaluation of silver’s role in the global economy.

Guides and Angels: Embracing the Presence of Spiritual Guides in Our Lives!

Strategic Considerations for Investors

Identifying Opportunities. Investors who understand the dynamics of the dollar to silver ratio and the derivative market can identify strategic opportunities. By anticipating shifts in demand and price adjustments, they can position themselves to benefit from market changes.

Risk Management. Given the volatility and potential for manipulation in the silver market, effective risk management is crucial. Investors should diversify their portfolios and consider hedging strategies to mitigate risks associated with silver investments.

Preparing for Future Market Shifts

Staying Informed. In a rapidly changing economic landscape, staying informed is essential. Monitoring key indicators like the US Debt Clock and understanding their implications can provide valuable insights for investment decisions.

Adapting Strategies. As market conditions evolve, so should investment strategies. By adapting to new information and trends, investors can navigate the complexities of the silver market and broader economy.

Final Thoughts: Navigating Uncertain Times

The recent developments in the US Debt Clock and the dollar to silver ratio underscore the importance of vigilance and adaptability in today’s economic environment. By staying informed and strategically navigating the market, investors can position themselves for success amidst uncertainty. As we move forward, the lessons learned from these dynamics will be invaluable in shaping future investment strategies and economic understanding.

https://twitter.com/echodatruth/status/1817820215989711295

![ARCHIVES OF TREASON: TRAITORS TO THE PEOPLE! Obama, Bush, and Clinton Pushed a Biological Weapon — Over 40 Million Dead and Counting. They Called It Science. History Will Call It Genocide. [VIDEO]](https://amg-news.com/wp-content/uploads/2025/05/Obama-Bush-and-Clinton-Pushed-a-Biological-Weapon-450x253.jpg)

![BOMBSHELL INTEL REPORT: INTERNAL BREACH AT MAHA COMMAND! Ric Grenell Executes Christian Operative in Deep-State Operation — Trump’s Anti-Woke Mission Compromised from Within [VIDEO]](https://amg-news.com/wp-content/uploads/2025/05/INTERNAL-BREACH-AT-MAHA-COMMAND-3-450x281.jpg)